I have decided to take a look at XP Factory following full year results on the 2nd September, give me a shout or common if you want any other companies looked at.

XP Factory - A quick summary

This is a simple business to understand, they run the Boom Battle Bar “pub” chains as well as Escape Hunt, the escape room leisure company. Boom Battle Bar was an acquisition a few years ago now but is the core part of the business with the Escape Hunt side making up less of a portion of sales.

The last few years have been spent rolling out the Boom Battle Bar sites in order to grow economies of scale and make it a viable business.

For me I feel like XP Factory should now be at this inflection point where the maturing sites are paying for future roll outs and we should be seeing bottom line profit. So, is that the case?

Results - 15 months.

To confirm, it is 15 months due a change in year end to avoid having year end at the end of the Christmas period, logical, fine. Bit of a pain now, but going forwards will make looking at this company easier.

Revenue of £57.3mil vs £22.8mil, 15 months vs 12 months but still a significant increase. EBITDA EBITDA EBITDA, hate this so I’ll move on down to the numbers to make my own verdict rather than the numbers XP Factory want me to see.

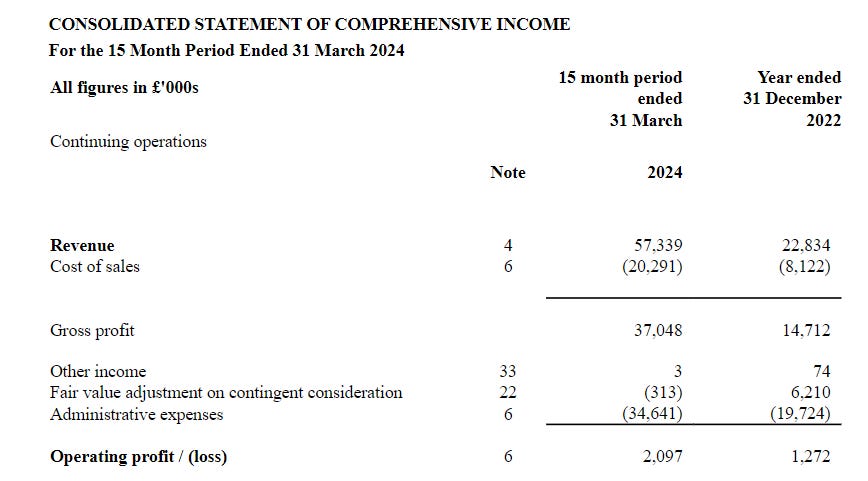

Income Statement

Revenue up as previously mentioned and cost of sales going up with it, makes sense. 65% gross margin both years, I would like to see this increase over time, but I’ll look at the notes to see if there is any logic as to why this hasn’t gone up with scale.

Okay, so staff costs are the biggest burden and scale won’t improve this as each site needs to be manned. Over time you might get discounts on the foods and beverages if you order in larger volumes but not enough to make a difference. So the real scale should need to come from the next line. Highlighting that “administrative expenses” of £34,641mil, that needs to be coming down to drive profitability higher.

Two main costs here, highlighted below, other administrative expenses (acquisitions?)

Now to move onto the Balance Sheet and Cashflow, I like to do it this way round, look at the numbers first and then read the wording at the start of the results, this way I can look for answers to my questions and also not get distracted by management talk before I get to the numbers.

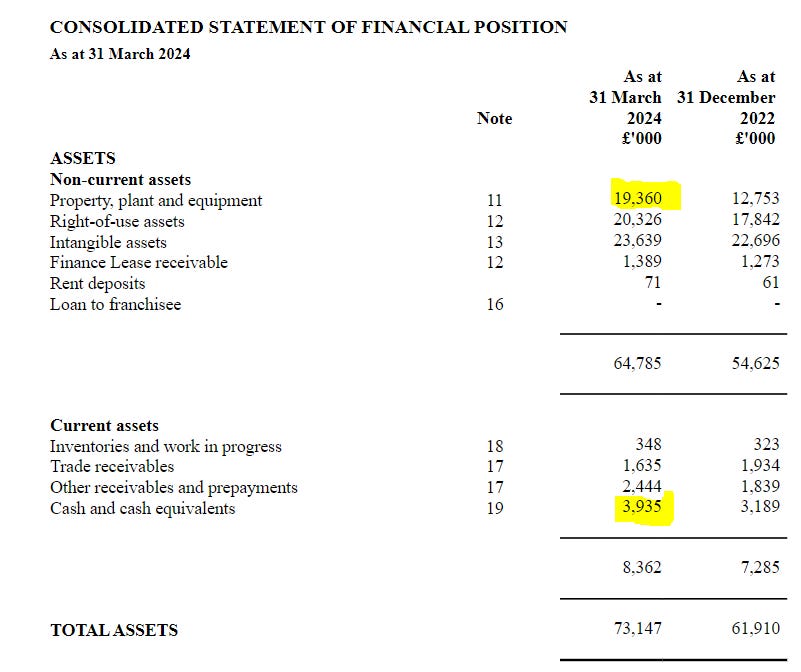

Balance Sheet

What I am looking for here is changes, they should be perfectly explainable.

The big change is Property increasing, makes sense as they have expanded you would expect this to increase. Cash looks okay and everything else is pretty static.

Payables are up a bit but not enough to be concerned by, they are a growing company and you would expect this, the fact receivables hasn’t gone up is due to it being a fast business, i.e. people buy drinks, it shouldn’t be something they don’t pay for months on end.

Lease liabilities also up a bit, again, that’s fine.

Nothing concerning on the Balance Sheet front, although “other loans” have crept up a bit.

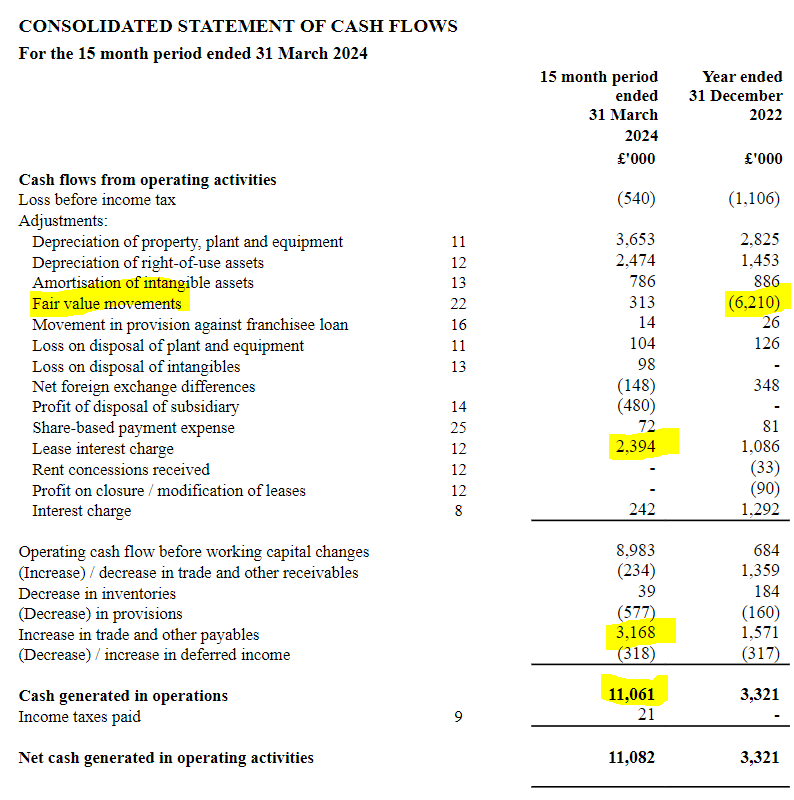

Cashflow

Again, just highlighting bits of interest. Why was the Fair value movement so high last year?

Lease interest charge up, but then we did highlight lease liabilities increasing and obviously this is 15 months vs 12 months and interest rates are higher.

Trade payables increase as we highlighted in the balance sheet, but overall good cash generation at this level. The second half is more interesting.

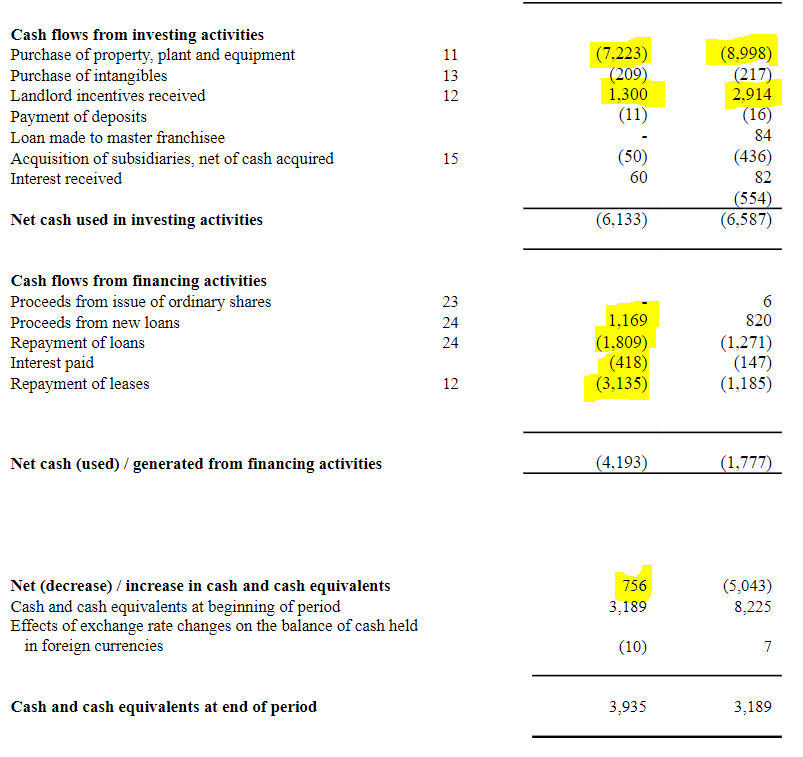

Purchase of Property, this is down, the question I have here is how much is going into old properties, i.e. refurbishments and how much is being spent on the new acquisitions. I.e. you open up a new Boom Battle Bar and need to spend money to get it done up, this is a one off expense, refurbs are ongoing.

Landlord incentives are dropping, this was a covid thing, places shutting down and struggling to rent out space, I can’t see this continuing.

Lease repayments have gone up, that is a positive although negative short term to cash flow, taking control of properties.

Overall though they were pretty much flat cash flow wise. Point 11 will show me what this looks like under the cover.

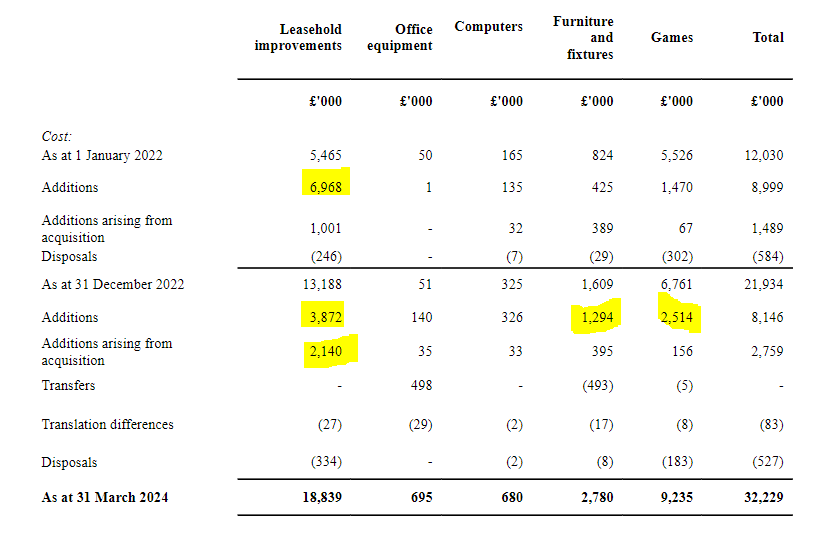

There has definitely been a notable increase in spend on Games and Furniture and Fittings. The games side is a concern as they will need to continuously spend here to keep the sites fresh and fun will they get to a stage where this spending is manageable and all sites are profitable? If they stop adding new sites then I could certainly see cashflow improve and for this to be profitable, but I can also understand why management do not want to stand still and want to carry on expanding.

Outlook

Finishing off slightly hastily as I spent too long on the numbers, but outlook.

A mixed outlook, July and August sound slightly flat and I think H1 could be underwhelming (ending September), but positive entering the second half of the year.

Summary - my views

I can see why this could be the start of a really interesting story, turning profitable and starting to generate cashflow and still a small company so should have plenty of potential for further rollouts.

Could the brand grow stale? This is why they need to spend on games to keep people coming back for different reasons. Students coming back for Uni would explain the stale July and August comments.

Market cap of £25mil would look quite reasonable if they could start turning £2/3mil in free cashflow.

I still feel a bit on the fence though, another 6 months will paint a clearer picture and show how sustainable this cash flow is and how much money needs to be put back into the maturing branches. The more you open the more you need to refurb.

For now, I’m staying on the side lines and need more proof that this business is sustainable. Yes, it might mean that the H1 results come out and give me the proof and I end up paying much higher to get in. But it would also derisk the proposition for me and make it more palatable. Right now it is early stage and high risk and not something I’m willing to throw money at.